Poo Poo to Potential: The Power of Indexing

Potential can be such an enticing, positive word. I’ve recruited and coached young men with potential. In my opinion, potential can also be a negative word. The young man that still has potential is not real useful in the game. Potential checks don’t cash very well at the bank. Potential returns are marketed to consumers, and consumers invest for potential all the time. Potential returns, at some point, are not real useful to you.

If I could guarantee you an average rate of return of +20% over the next two years, would you take it?

- If you invest $100,000 and have a 100% gain in the first year, at the end of the year balance is $200,000.

- In year two, let’s say your investment lost -60% or -$120,000 from $200,000 leaves you with a balance of $80,000.

- Your average return is 20%, your real return is -20%

This hypothetical equation is how investors are sold on potential. The fact of the matter is, as an investor, it’s not how much you earn. It’s how much you keep that is important. If you never lose, you can be much farther along in the future.

- If you invest $100,000 and have a 100% gain in the first year, at the end of the year, your balance is $200,000.

- In year two, the market drops 60% and you lose nothing. At the end of the year, you have $200,000 and your average return is 50%.

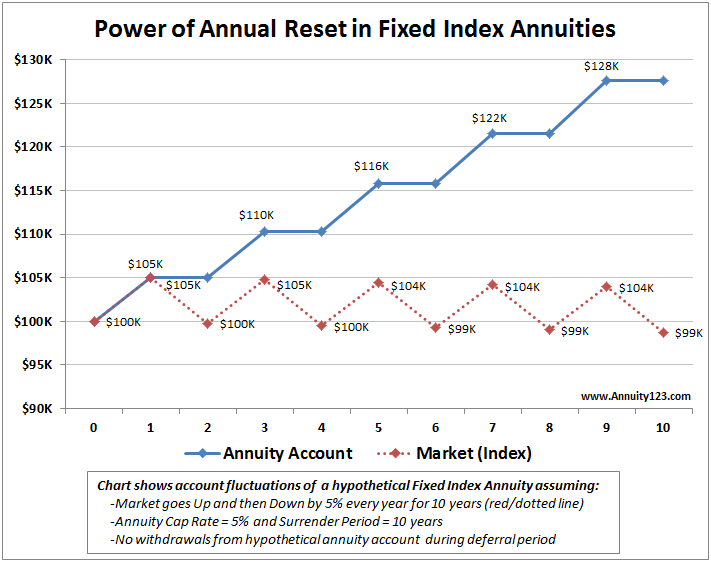

This is the power of indexing. Indexing is getting upside growth when the index is growing, and NEVER losing when the markets are falling. At each contract anniversary, you lock in the gains of the past year and reset for the next year, never turning back. This feature is referred to as annual reset.

When you have the power of indexing, coupled with a personal pension, you now have an equity index annuity. These two features, indexing and your “pension” (or income rider) provide two values on your contract.

Personal pension: To create your personal pension, add a lifetime income rider. Although different companies may call this rider by a variety of names, the insurance contract will guarantee a certain rate of return (currently 6%-7% compound interest at time of writing) until a time in the future, (which you choose) when you begin your “pension,” or payments to you for the rest of your life.

To learn more from this annuity professional, click here (Richard Ericson).

P.S. – Please share this article with others by simply clicking on the blue social media icons at the top of your screen!

Annuity123 does not offer insurance, investment, or tax advice. You should always seek the guidance of qualified and licensed professionals concerning your personal insurance, investment, or tax matters. Annuity123 is simply a platform allowing retirement planning professionals to help educate the community on various retirement planning topics. Annuity123 does not directly support or take responsibility for ensuring the accuracy of the content displayed in the articles themselves or any feedback that may get added in the Comments section from the community.

2 Comments

Show me where you can get a 100% upside return and then no loss when the market heads south 60%. This is a misleading comparison. The indexing you talk about is capped at 5%. Let's keep the numbers realistic. Equity indexed annuities are not growth vehicles, lets keep the talk about potential for Wall Street and the guarantees for the annuity.

My point exactly. An annuity does provide guarantees, that are real and yes, they are an excellent growth vehicle. If the majority of Americans had at least 50% of their invested net worth in one of these types of vehicles prior to 2000 and 2008, they would still have all of the wealth they had prior to the last two market corrections, and growth on top of those values. For us and our clients, taking a portion of their assets and positioning them into something safe, that will grow, and is insured so that they can know it will always be there for them is a tremendously important piece of their financial peace of mind. At the end of the day, it doesn’t matter how much you earn, it matters how much you keep and get to use that counts. The hard facts are that the most successfully retired individuals are usually those individuals who are fortunate enough to retire with a pension, which generates the necessary income to provide for their basic living needs, and then they get to use their investments to solve their fun and recreational lifestyles. In essence, what we are doing is helping our clients set up their personal pension plan with these annuities, which are usually comprised of a PORTION of their invested assets, and then we invest the “fun” or recreational lifestyle monies in more traditional investments. Many clients have seen 10% to 15% growth last year in their indexed annuities. And, for even higher caps, and TAX FREE income, while protecting ones assets, ……….