The Power of Locking in Your Gains

When obtaining any type of financial vehicle, there is typically some type of risk-return tradeoff. For instance, in today’s low interest rate environment, it’s tough to obtain the growth that you need, yet it’s important to also play it safe in order to protect your principal.

The fixed indexed annuity, or FIA, can provide a great solution for offering the potential for market-related growth, yet protection from downside risk. This can in turn help you to generate more retirement income down the road.

Ensuring that Gains are Locked In

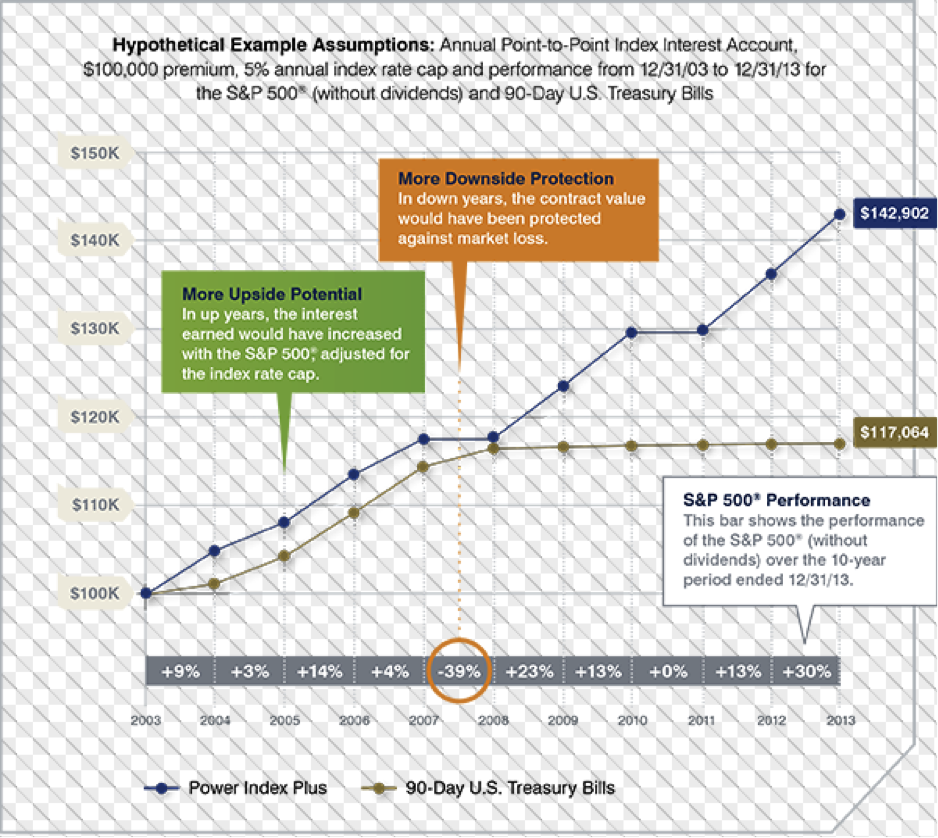

One of the key benefits available on a fixed indexed annuity is the annual reset feature. This feature allows the fixed indexed annuity’s index values to automatically reset at the end of each contract year.

Because the interest that is earned is essentially “locked in” each year and the index value is reset at the end of every year, future decreases in the underlying market index won’t have any effect on the gains that you’ve already earned in the FIA. This provides the annuity with the ability to earn more interest than other types of annuities, which could end up losing money when the underlying index goes down.

Benefiting With Reset

In fact, with the annual reset feature, your fixed indexed annuity can benefit regardless of whether the underlying index goes up or down in a given year. How is that possible?

When the index has an up year, the fixed indexed annuity account value will receive the market-linked growth as interest credited to the account value. This growth will then be locked in and reset as the following year’s beginning balance.

If, however, the FIA’s underlying market index has a negative year, the annuity will receive no interest for that year credited to the account. Although this may initially appear to be a negative thing, the good news is that the annuity didn’t lose any money.

Also, in this particular scenario, the value of the annual reset can actually be two-fold. First, the value of the FIA’s account will be protected from the market downturn and it will not decrease. And second, the starting balance for the following year will not require the annuity owner to “make up” for any lost value in the account.

It’s easy to see that the annual reset feature can make a substantial difference to the ultimate return that is gained in a fixed indexed annuity—especially over time. This can, in turn, have an effect on the amount of retirement income that can be generated from the funds that are in the FIA account.

In addition to the annual reset feature, a fixed indexed annuity can also provide other key benefits that can enhance your retirement savings too, such as:

- Tax-Deferred Growth – There are no taxes due on any of the gains that are earned in a fixed indexed annuity until the time of withdrawal. This means that funds are able to grow faster than those that are in a taxable investment account, and they can essentially earn interest in three different ways: The interest that is earned on the principal, the interest that’s earned on the interest and the interest that you earn on what you didn’t pay in taxes.

- Beneficiary Protection – Should unexpected death occur, assets from a fixed indexed annuity may transfer directly to a named beneficiary. This can help avoid going through the time consuming and, oftentimes, costly process of probate.

While a fixed indexed annuity may not be the ideal solution for everyone, it could be the solution for you, if you’re seeking a way to grow retirement funds without having to worry about market-related losses.

By including the annual reset feature to a fixed indexed annuity, you won’t have sleepless nights trying to figure out ways to earn back hard-earned retirement principal due to “hiccups” or corrections in the underlying index.

Thanks to the fixed indexed annuity, not only can retirees have ongoing lifetime income, which puts retirement in their control, but now those who are not yet retired can put their pre-retirement savings plan in their control as well.

P.S. – Please share this article with others by simply clicking on the blue social media icons at the top of your screen!

Annuity123 does not offer insurance, investment, or tax advice. You should always seek the guidance of qualified and licensed professionals concerning your personal insurance, investment, or tax matters. Annuity123 is simply a platform allowing retirement planning professionals to help educate the community on various retirement planning topics. Annuity123 does not directly support or take responsibility for ensuring the accuracy of the content displayed in the articles themselves or any feedback that may get added in the Comments section from the community.

3 Comments

I have seen many articles on what annuities are but none on how they would work. For example, If I purchased an annuity for 100,000 at age 69, what would be the best type for me and my children, and what can I expect to receive over my lifetime and then what would go to the children?. I understand that you cannot outlive the distributions, but I am sure that the insurance companies set the payout so low that you would only get your investment back at best.

Dave: I might be interested in the FIA (fixed income annuity). What is the minimum dollar amount necessary to establish an account.

Rob,

Good afternoon. I am very sorry but I am just now reading your comments from the website. For more information, please call us 877-424-6748 or send us an email to: dave@mortachfinacial.com Thanks.

Terry