What In The World Is An “Annual Reset” Indexed Annuity?

There are several different kinds of index annuities, but the “Annual Reset” type is the most commonly sold (and bought). The name refers to the interest crediting period – the length of time over which gains and losses in the equity index (often, but not always, the S&P500®) will be measured and index-linked interest will be calculated and credited. There are different types of annual reset annuities. Some measure monthly index movements, from which they calculate and credit interest annually (the “Monthly Sum” or “Monthly Average” types). By contrast, the “Annual Point to Point” measures index movement using only two index values – the Beginning Value (as of the annuity issue or anniversary date) and the Ending Value (one year later) – which is why it’s called the “Annual Point to Point” (APP) method. This type of index annuity is the easiest to understand, and it’s what we’ll be examining in this article. But it’s important that we understand that all “annual reset” types credit interest annually and “reset” the index starting value (from which index-linked interest will be calculated) at the end of each contract year.

How does “Annual Reset” work in an “Annual Point to Point” index annuity?

On the issue date of the annuity, the value of the index (we’ll use the S&P500®, as it’s the most commonly chosen index) is recorded. One year later, on the policy anniversary, the index value is again recorded and the difference between the two values, as a percentage of the beginning value, is calculated. If the index showed a loss (the ending value was less than the beginning value), the contract is credited with zero percent interest. Index losses in an Annual Point to Point annuity are treated as zero percent gain. If the ending index value was higher than the beginning value (i.e.: the index showed a gain), that percentage gain is credited to the contract after adjustment for Participation Rate and Cap Rate.

Participation Rate

The “Participation Rate” is the percentage of index gain that will be recognized for purposes of index-linked interest crediting. There is a very common misconception that if the participation rate is less than 100%, the insurance company “keeps” the difference. This is a myth. Issuers of index annuities buy bonds to back the contractual guarantees, and this typically takes most of the premium. After paying for the bonds, expenses, and the company’s required profit margin, the remaining premium is typically invested in call options on the index (which pay off if the index gains value). Usually, there is not enough left to buy options on 100% of future index gain. If the insurer can buy options on only a fraction of that gain, it can credit interest on the annuity only on that fraction. If there is no gain in the index or if the index value declines, the call options expire worthless and the insurer credits the annuity with zero percent interest.

Cap Rate

The “Cap Rate” is an upper limit on the amount of interest that will be credited. Insurers impose this limit to limit their risk exposure and because the call options they purchase often have their own cap rates. Often, an index annuity imposes both a participation rate and a cap rate. When this is the case, the index crediting works like this:

The S&P500 index value grew by 11% over the contract year.

If the participation rate is 60%, the resulting index value is 60% of 11% – 6.6%. If the cap rate is 5%, the annuity will be credited with 5%. In other words, the annuity will be credited with 60% of the index gain, but not more than 5%. If the index declined, the annuity will be credited with 0% interest.

One of the big attractions of an Annual Point to Point annuity – or any index annuity that uses “annual reset” – is what happens after the index has declined. In such a “down year”, the index annuity loses no money; its value at the end of the year is the same as at the beginning. But the next year’s “baseline” (from which index gains will be calculated) is reset to the index value after the loss. Any “rebound” in the index will result in index-linked interest even if the index value does not recover the previous year’s loss.

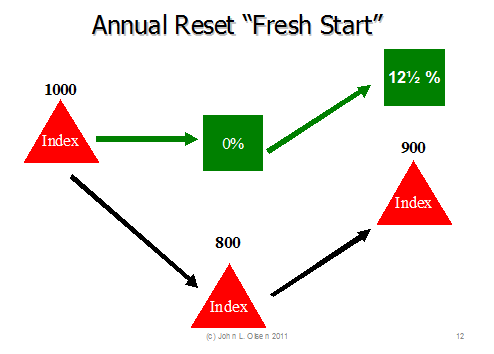

Here’s a graphic example:

If the index in the first year declines by 20%, the index annuity value remains unchanged. When the index “rebounds” by 12% (half of the previous year’s loss), the index value is still less than at the beginning of the first year, but the annuity will be credited with interest based on a gain of 12.5%. At a 60% participation rate, the interest credited will be the higher of 7.5% (60% of 12.5%) or the cap rate.

If the index in the first year declines by 20%, the index annuity value remains unchanged. When the index “rebounds” by 12% (half of the previous year’s loss), the index value is still less than at the beginning of the first year, but the annuity will be credited with interest based on a gain of 12.5%. At a 60% participation rate, the interest credited will be the higher of 7.5% (60% of 12.5%) or the cap rate.

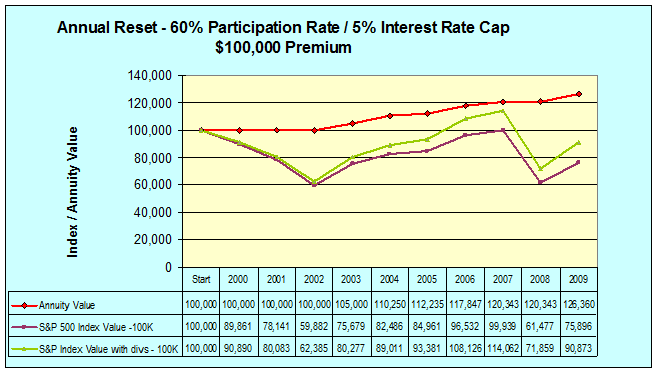

Here’s an example of an Annual Point to Point index annuity with a 60% participation rate and a 5% cap rate:

The S&P500® value, without dividends, from the beginning of 2000 through 2009 is reflected in the blue line. The value with dividends is shown as the green line. In both, the extreme market volatility in that period resulted in a loss after ten years. But the index annuity(the red line) earned over 26% in that period. While it did not participate in more than 60% of the index gains, it participated in none of the annual losses.

The S&P500® value, without dividends, from the beginning of 2000 through 2009 is reflected in the blue line. The value with dividends is shown as the green line. In both, the extreme market volatility in that period resulted in a loss after ten years. But the index annuity(the red line) earned over 26% in that period. While it did not participate in more than 60% of the index gains, it participated in none of the annual losses.

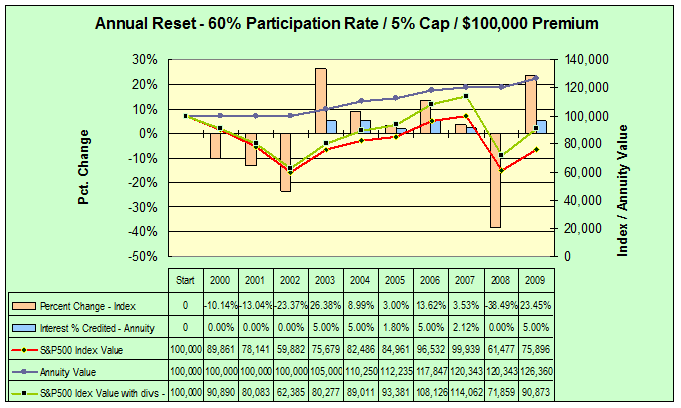

Here’s another look at that same annuity, with the same index performance:

The brown rectangles represent index growth or loss. The blue rectangles show index-linked interest credited to the annuity. In this scenario (actual historical performance of the S&P500®, with and without dividends, from 2000 through 2009, an index annuity with a 60% participation rate and a 5% interest rate cap), the annuity actually outperformed the underlying index. This is not a result anyone should count on. In most historical situations, an index annuity will underperform the underlying index, often significantly. An index annuity is a fixed annuity, offering the same guarantees of principal and minimum rate of interest (although some contracts offer a minimum interest rate guarantee barely greater than zero), and is not an alternative to investing in equities.

The historical situation shown in the graph is unlikely to be repeated often, but it was chosen to demonstrate that even when an “annual reset” index annuity offers low participation rates and cap rates, it can perform well, compared with “safe money” alternatives – especially in a highly volatile market environment.

Disclosure: Some of the material in this article was taken from “Index Annuities: A Suitable Approach” by Jack Marrion and John Olsen (Olsen & Marrion, LLC, 2010 – available at www.indexannuitybook.com).

Click here for more articles from this author.

P.S. – Please share this article with others by simply clicking on the blue social media icons at the top of your screen!

Annuity123 does not offer insurance, investment, or tax advice. You should always seek the guidance of qualified and licensed professionals concerning your personal insurance, investment, or tax matters. Annuity123 is simply a platform allowing retirement planning professionals to help educate the community on various retirement planning topics. Annuity123 does not directly support or take responsibility for ensuring the accuracy of the content displayed in the articles themselves or any feedback that may get added in the Comments section from the community.

4 Comments

John, your explanation is extremely well articulated and illustrated as well. This should be required reading for all advisors new to index annuities.

Thank you very much, Drew. Your comments are greatly appreciated. Helping people – agents and consumers – to understand how and when annuities work, and when they don’t, has become quite a passion for me. It’s why Jack Marrion and I wrote “Index Annuities: A Suitable Approach” and why I wrote “Taxation and Suitability of Annuities for the Professional Advisor”.

There is so much inaccurate and misleading information out there about annuities – both pro and con – that consumers can often form judgments about these products that can lead to bad decisions.

Hello, I am 53 and my portfolio hasn’t done much in the last 20 years. When I was in my 30’s I didn’t contribute much, now that my kids are grown and I am debt free (except for a small mortgage payment) I am able to invest $1500.00 a month and I am so confused, I don’t know who to trust?? I recently switched investment firms and now deeply regret it. I would like to know if you can contribute to your annuity? or is it a roll over with no contribution? and I have heard terrible things about the withdrawal process of your annuity when you are able to start doing this. Who can I talk to, to decide if this is for me? and most importantly who would have my best interest? That’s what I am finding is most difficult, having a person I can trust.

Robert,

I am 66 and having to make some financial decisions as I move out of the workforce and rely totally on SS and investments. I have been advised to use the 100 rule. 100 – age is the most percent of my investments that I should have at risk; stocks, bonds, and mutual funds so 90 percent of the rest I am looking at putting in a Index Annuity with Annual Reset. The rest will remain as cash.