How Did Fixed Index Annuities Actually Perform in 2013?

According to The Index Compendium, Jan 2014, “Although a few annuities ended the year crediting 5% to 6 % interest – and a couple product methods credited over 20% – the reality is most Index Annuities purchased December 2012 credited 2% to 3% in December 2013.”

So why the huge discrepancy in credits? Jack Marrion, editor of Index Compendium, believes it is simply that the low bond yields a year ago did not allow carriers to buy much upside with their index link.

But the reality is there are some “A” rated Fixed Index Annuity companies that credited over 20% last year which stresses the importance of finding the right agent who is watching the crediting strategies very closely. Many brokers, especially ones that work with the larger more familiar named companies, are only allowed to contract with a few annuity companies and are limited in the annuities they can offer. It is critical to find an independent agent who is not limited to whom they can contract with, is extremely knowledgeable in the area of FIAs, and can offer a variety of options customized for your needs.

Even though the lowest Index Annuity returns were still 10 times higher than the average one year CD rate and three times higher than the top performing money market account, it should be noted that there is a wide variety of annuities and you should be very prudent when choosing an advisor who specializes in Fixed Index Annuities.

“Those against FIAs will remind you that domestic stock indices with reinvested dividends were generally up 30% or more for 2013 thus showing index annuities are a bad investment… but comparing an index fund to an index annuity is as silly as comparing a Savings Bond to a junk bond mutual fund. Bonds were the more important story of the year”

Vanguard’s Total Bond Market Index lost 2%, the Long Term Bond Index lost 9% and the Long Term Government Bond Index dropped 12%.

The Wall Street model has always been to use both stocks and bonds and even with the 2013 losses, many advisors are still pushing bonds. More than ever, it makes sense to use a Fixed Index Annuity that protects you from loses and can still beat quality bond yields.

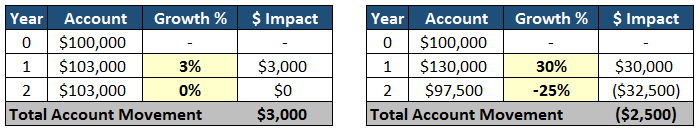

You wind up with more money earning 3% one year and 0% the next than gaining 30% one year and losing 25% the next. Many believe you are still up 5% but that is simply not the case, you have actually lost money as displayed in the tables below.

It is also important to remember that these losses occur in Variable Annuities as well. Do not fall victim to the pitch that you are protected from downside loses in a variable annuity just because you have put an income rider on the policy. You can only get money from that guaranteed income account as the company determines, based on their payout options and based on their rules. If you want to cash out or make a withdrawal, your money comes from your account that is at market risk to losses and is not guaranteed. Many consumers are mislead into believing Variable Annuities and Fixed Indexed Annuities offer the same protection. That is far from the truth.

Click here to see more educational articles from Laura Johnson.

P.S. – Please share this article with others by simply clicking on the blue social media icons at the top of your screen!

Annuity123 does not offer insurance, investment, or tax advice. You should always seek the guidance of qualified and licensed professionals concerning your personal insurance, investment, or tax matters. Annuity123 is simply a platform allowing retirement planning professionals to help educate the community on various retirement planning topics. Annuity123 does not directly support or take responsibility for ensuring the accuracy of the content displayed in the articles themselves or any feedback that may get added in the Comments section from the community.