Taxation of Annuities Explained

Are you considering investing Non-Qualified (non-IRA) money in the Total Value Annuity, American Equity Bonus Gold, Allianz Core Income Benefit, Athene Choice 10, Security Benefit’s Secure Income Annuity, or any other deferred annuity? It may be a good investment for the savings and income portion of your money, but then again it may not. This article is intended to provide you with tax information that will help you make more informed decisions when deciding which investments will work best for you near or in retirement.

Before we jump in to this topic, you need to be aware of a few things. First of all, I haven’t confirmed this figure, but the whispers on the street tell me that our great country’s tax code consists of over 73,000 pages. Needless to say taxes are incredibly complicated so please consult a tax advisor about your specific situation before making any financial decisions.

There are several topics related to taxes and annuities but for the sake of this article we will discuss compounding tax deferral, the taxation of Non-Qualified Annuity withdrawals, annuitization, Net Investment Income Tax (NIIT), and taxation to beneficiaries upon death. Please refer to http://www.irs.gov/pub/irs-pdf/p575.pdf for further guidance.

Compounding Tax Deferral Interest

Annuities are tax-deferred vehicles. That means if you are depositing after tax money you won’t pay tax on the growth/interest earned until you actually withdrawal it (I did not say tax free…see the step up basis section of this article and pay close attention to the withdrawal taxation discussion). This creates a compounding growth effect on your hard earned cash. Investopedia defines compounding as “the ability of an asset to generate earnings, which are then reinvested in order to generate their own earnings. In other words, compounding refers to generating earnings from previous earnings.”

What does that mean?

Assume you invested $1,000,000 and earned 6% in 2008, 5% in 2009, and 3% in 2010. If your investment is not tax deferred you would receive a 1099 (the type of 1099 depends on the investment type) notice for the interest earned in the applicable year. For example, if you earned $60,000 in ordinary interest from a CD in 2008 and your tax rate is 28%, then your after federal tax profit would be $43,200 ($60,000 less 28% tax). Even if you did not withdraw money from your investment, you have an obligation in a non-tax deferred vehicle like CDs to pay taxes on the interest earned in the applicable year. This means that your tax obligation ($16,800) won’t participate in the compounding growth of of the rest of your savings/investment. If there are taxes at the state level you are left with even less to re-invest. Depending on your tax bracket and the amount of profits you can see how this could make a big impact on your tax obligation and your potential to benefit from compounding.

Tax Deferred vehicles, on the other hand, don’t pay taxes on profits unless the investors sell the instrument or take a withdrawal. Tax deferred instruments enable your investment to earn interest on top of interest on top of money that would have gone to taxes!

Annuities are not the only way to achieve tax deferral and compounding, but for the sake of this article, that’s what we will focus on.

If you learn like I do then numbers speak louder than words and you’ve struggled to get through the last few paragraphs. Lucky for you the table below illustrates the power of compounding in numbers instead of words. The table below compares the growth of a CD and a tax deferred Annuity (applicable to indexed, fixed, and variable deferred annuities) over a 20-year period. We use these instruments because they appeal to similar investors who have similar objectives/experiences. People that fit this profile:

- Felt devastation during the tech bubble and again in 2008 and first quarter of 2009

- Want to ensure that part or the majority of their investments avoid similar devastation in the future (see my next blog about taking withdrawals during poor performing market cycles to see this impact)

- Are within 10 years or are in the process of converting their investments into their primary or supplemental income stream

- Are not comfortable or don’t understand the risk associated with various portfolios exposed to stock, bond, and real estate markets

But want to:

- Earn more interest than checking/savings accounts

- Create steady income from investments

- Create potential to outperform other investments/savings vehicles with similar risks (inflation)

- Invest money with well-known institutions that have FDIC or State Insurance Guaranty association backing

The table below shows the long-term benefits of tax deferred compounding interest by comparing a Deferred Annuity Account to that of a CD. The table assumes that no withdrawals are made from either account during the 20 year period and that both accounts earn 5% interest each year.

After 20 years of compounding the annuity investor ends up with $468,000 ($1,989,973 less $1,521,445) more than the investor who does not receive the benefit of tax deferral and compounding! Although each investor is getting the same yield and started with the same initial investment the results are different. Recalculate the average annual return using arithmetic math and you can see that compounding actually increased the rate of return on the annuity to over 8% per year. This is the benefit of compounding and tax-deferral. It looks amazing on paper and is real value…but of course Uncle Sam eventually wants his money.

Since the CD investor already paid tax on annual interest, he/she will only owe taxes on future interest earned while the annuity investor must account for a future tax bill upon the distribution of his/her gains. This brings us to the distribution phase of Non-Qualified annuities.

Taxation of Non-Qualified Annuities

There are several ways to withdraw money from a Non-Qualified Annuity and each are treated different at the Federal tax level. Two ways in particular are withdrawals and annuitizations. IRS Publication 575 discusses how Non-Qualified Annuity withdrawals are taxed but since this publication is nearly 40 pages long, I can’t write about each of them in this blog. If you have more detailed questions about distributions feel free to call or email our office and I will be happy to provide you information about your specific questions.

Taxation of Non-Qualified Annuities Withdrawal Example:

To illustrate the taxation of a Non-Qualified Annuity withdrawals, let’s assume that Erin S. is the person who invested in the tax-deferred annuity mentioned in the table above. The following are critical facts for our example:

- The values are pulled from the table above

- The year is 2013

- Erin is over 59 ½ (if Erin is not 59 ½ there would be an additional 10% penalty from her annuity withdrawal)

- Erin is planning to pay cash for a new beach house in Wilmington, NC

- Erin will withdraw $1,339,973 from her Non-Qualified Annuity

- Erin makes her withdrawal at end of year 20 (so the annuity cash value is $1,989,973.28 and the original investment was $750,000)

Is this considered a periodic payment or just a withdrawal? The IRS with the help of the insurance company determines if your withdrawal is periodic or not (see annuitization). The withdrawal in this example will not be considered periodic therefore the IRS considers your withdrawal as a return of gains first followed by a return of the basis (your original investment). That means the first $1,239,973 of Erin’s withdrawal COUNTS AS ORDINARY INCOME and Erin WILL receive a 1099 for this amount from the insurance company. She must include this as income on her 2013 tax return. The remaining $100,000 of the withdrawal is a return of Erin’s original deposit and WILL NOT count as income.

If we hold all other variables equal except we assume Erin only withdrew $100,000 then the entire $100,000 would count as ordinary income. Erin would now have $1,139,973 in remaining gains that that would to be taxed upon withdrawal (plus any new gains earned in the future).

Annuitization:

Annuitizing receives different treatment than withdrawals. By electing to annuitize, the investor typically looses access to the corpus of the investment in exchange for a monthly, quarterly, semi-annual, or annual payment for a specified period of time or for life. The investor also loses optional death benefits, contract value at death (depending on the timing of the election and contract terms the contract value could be realized over a specified period of time) and most other features purchased with the annuity. Annuitization receives the periodic payment tax treatment mentioned above. An example of this is illustrated below.

Taxation of Annuitized Payments Example:

Non-qualified annuitization payments are treated different than withdrawals. A portion of the annuity check represents the principal (not taxed) and a portion represents earnings (taxable at ordinary income tax rates).

For example, Jason S. deposited $200,000 into annuity three years ago. Due to unexpected expenses Jason chooses to annuitize his annuity to improve his cash flow. He chooses a 10 year period certain payout and will receive $2,300 per month during that time. Part of this $2,300 monthly payment will be tax free, the other portion will count as ordinary income on Jason’s tax returns. The taxable amount is determined before annuity payments begin. The taxable amount is calculated based on several factors including but not limited to the amount of interest earned inception to date, the amount of future interest earned (predetermined before payments begin), and the number of future payments.

Thinking, discussing, and teaching about taxes makes me cringe… but at least we’re done with that topic… wait… there’s more! Meet the Net Investment Income Tax!

Net Investment Income Tax (NIIT)

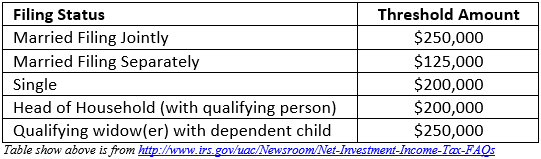

Effective for 2013, certain individuals, estates, and trust will have the pleasure of paying a new tax called the Net Investment Income Tax. Individuals will pay an additional 3.8% in tax to Uncle Sam if they have Net Investment Income and a modified adjusted gross income over the amounts listed below:

Included in Net Investment Income are: Non-Qualified Annuities, dividends, capital gains, interest, rental income, and income from businesses involved in trading of financial instruments or commodities and businesses that are passive activities to the taxpayers.

Distributions from Qualified plans (IRAs, 403 (b)s, 401 (k)s and others) are not considered investment income.

Step Up in Cost Basis

When someone passes away and leaves their stocks, bonds, mutual funds, properties, and many other assets to family members, the beneficiary often receives the assets at a stepped up cost basis. What does this mean? The example below should provide some clarification:

- John Smith purchased Apple stock November 27th 2009 for 200/share.

- John Smith never sold his stock; unfortunately John passed away January 27, 2014 when Apple was trading at 552/share.

- John Smith’s heirs don’t have to pay tax on these gains even if they choose to sell the stock on January 28 2014 because they receive a stepped up basis. Instead they would pay tax on any profits between the date of death and the time they actually sell the stock.

Meanwhile, Non-Qualified annuities do NOT receive the stepped up basis treatment mentioned above. Instead, the deferred earnings are taxed as ordinary income to a non-spousal beneficiary. For example, we will assume the following:

- John Smith is the person who invested $750,000 into the Non-Qualified Annuity we mentioned in the table above.

- Unfortunately John passes away on the first day of year 20.

- John did not w/d any money from the annuity before death.

- John’s son and daughter are 50/50 beneficiaries of John’s assets.

- The beneficiaries choose to receive the annuity in a lump sum check.

Each child will receive a check for $947,606 ($1,895,213 split in half). From the table above we see the annuity contract has $1,145,213 in gains. Since each child participates in ½ of the gain, $572,606 will be reportable as ordinary income on their tax returns.

Note: John’s family may have to pay estate taxes on the size of his estate depending on which states are involved, but gains from the stock’s growth in this example are only taxed based on the growth from the date of John’s death to the date of sale.

As you can see, different tax treatments apply to different investments/savings upon death. Taxes are about as much fun as watching paint dry, but knowing how your investments are taxed under different circumstances will drastically reduce the chances of a surprise for you or your beneficiaries in the future.

Click here to see more of Jason Soloman’s articles.

NOTE: TACTICAL INVESTMENT ADVISORS IS NOT A TAX ADVISOR AND THIS IS NOT A TAX RECCOMENDATION. FOR ADVICE ABOUT THE TAXATION OF YOUR PARTICULAR SITUATION, PLEASE CONSULT YOUR TAX ADVISOR.

P.S. – Please share this article with others by simply clicking on the blue social media icons at the top of your screen!

Annuity123 does not offer insurance, investment, or tax advice. You should always seek the guidance of qualified and licensed professionals concerning your personal insurance, investment, or tax matters. Annuity123 is simply a platform allowing retirement planning professionals to help educate the community on various retirement planning topics. Annuity123 does not directly support or take responsibility for ensuring the accuracy of the content displayed in the articles themselves or any feedback that may get added in the Comments section from the community.

9 Comments

Nice job! I would add that it's not difficult to distinguish between "periodic payments" (technically, called "amounts received as an annuity"), which are taxed under the "exclusion ratio" rules of IRC Sect. 72(b) and withdrawals (AKA "partial surrenders") that the Code and Regs call "amounts not received as an annuity" and are taxed under the rules of IRC 72(e).

In general, the ONLY distributions from any annuity that qualify as "amounts received as an annuity" are distributions under a regular ANNUITIZATION option. The one exception I'm aware of is payments made under the Guaranteed Lifetime WITHDRAWAL Benefit of Lincoln National's "IForLife" product. Those payments were ruled, in two Private Letter Rulings, as "amounts received as an annuity", provided that the contract owner chose a specific option in that product.

It's also worth noting that regular annuity payments (under a regular annuity payout option) from an annuity where the Annuity Starting Date was after 12/31/1986 are taxed under the "exclusion ratio" regime only until all investment in the contract has been received tax free. After that point, all annuity payments are taxed 100% as Ordinary Income.

Thanks John! I'm not familiar with Lincoln's iForLife product, is there a different feature exclusive to the iForLife product or is this a sign of things to come? You seem pretty well versed in the taxation of non-qualified annuities…you may be also find interest in a piece l plan to write next month that will dive into the pros and cons of 1256 contracts.

Whats interesting is that the reporting varies from co to company regarding the 1099 treatment of rider based income. Ex: Security Benefit reports different then Aviva and so on. Validates there is a bit of confusion even within the industry on this.NIce write up!

Thanks John! I'm not familiar with Lincoln's iForLife product, is there a different feature exclusive to the iForLife product or is this a sign of things to come? You seem pretty well versed in the taxation of non-qualified annuities…you may be also find interest in a piece l plan to write next month that will dive into the pros and cons of 1256 contracts.

Thanks John! I'm not familiar with Lincoln's iForLife product, is there a different feature exclusive to the iForLife product or is this a sign of things to come? You seem pretty well versed in the taxation of non-qualified annuities…you may be also find interest in a piece l plan to write next month that will dive into the pros and cons of 1256 contracts.

Thanks Blair! This may sound ridiculous but it’s shocking and a not shocking that two insurance companies of their stature can produce that many 1099′s and have inconsistent treatment. Once the IRS takes a solid stance on Lifetime Income riders it will be interesting to see how they treat future income flows from investors that already started the Lifetime Income process.

We've received lots of inquires about "taxation of annuities" and "annuity taxation" from visitors over the recent past, so this article has filled a much needed gap… well done Jason!

Thanks Luke. There will be a few more tax articles on the way as soon as I can get a few tax returns off my plate!

Just inherited a a couple of non qualified fixed annuities and want to cash them in. They are approximately 27 years old. They have a fixed interest rate of 4.5%.

Do I have to pay taxes as ordinary income for all the interest that was paid during those 27 years.

Thank in advance for any answer that you might give