Why Is An Index Reset Critical To Retirement?

People purchase annuities for a number of different reasons. Certainly, ensuring a lifetime stream of retirement income is one of the primary factors for purchasing this type of financial vehicle. But while the annuity is still in its funding—or accumulation—phase, it is also important to make sure that you are able to grow and protect the funds that are inside of the account.

Using a fixed indexed annuity, or FIA, can be an ideal way to generate a retirement income. These annuities credit interest based upon the performance of an underlying index, typically the S&P 500, yet they also provide you with valuable downside market protection.

Locking in Market Gains

One of the most powerful advantages of a fixed indexed annuity is the annual reset feature. This option allows the annuity owner to lock in the prior year’s gains, without the worry of losing those gains in the future.

What this means is that the prior period’s ending value will become the following period’s beginning value in the fixed indexed annuity. In addition, the automatic reset feature will also lock in any interest that the FIA has earned during that time period. Therefore, a negative index return from one year will not have an effect on the next year’s return.

Using an example, let’s say that an annuity is purchased that has an annual reset feature. If the underlying index has a negative year, then even though there is no interest that is credited to the annuity, the owner of the FIA will also incur no loss either – and the annuity’s value will automatically reset on its anniversary date at the same value that it was the prior year.

If, however, the underlying index has a positive return, the FIA will be credited with a positive return as well, and the annuity will therefore reset on the anniversary date at a higher amount. This higher amount will then become the annuity’s new value at the beginning of the following year.

When you have the reset feature on a fixed indexed annuity, then, one of the biggest advantages is that you won’t lose any of your principal when the underlying market index is down, but you still hold on to the opportunity to earn more when the underlying index is up. And, those gains will be locked in going forward for future years.

As an additional benefit of the annual reset feature, the annuity won’t need to make up for any prior year’s losses because essentially, there aren’t any losing years. This means that each year, the worst position your annuity will be in is 0%.

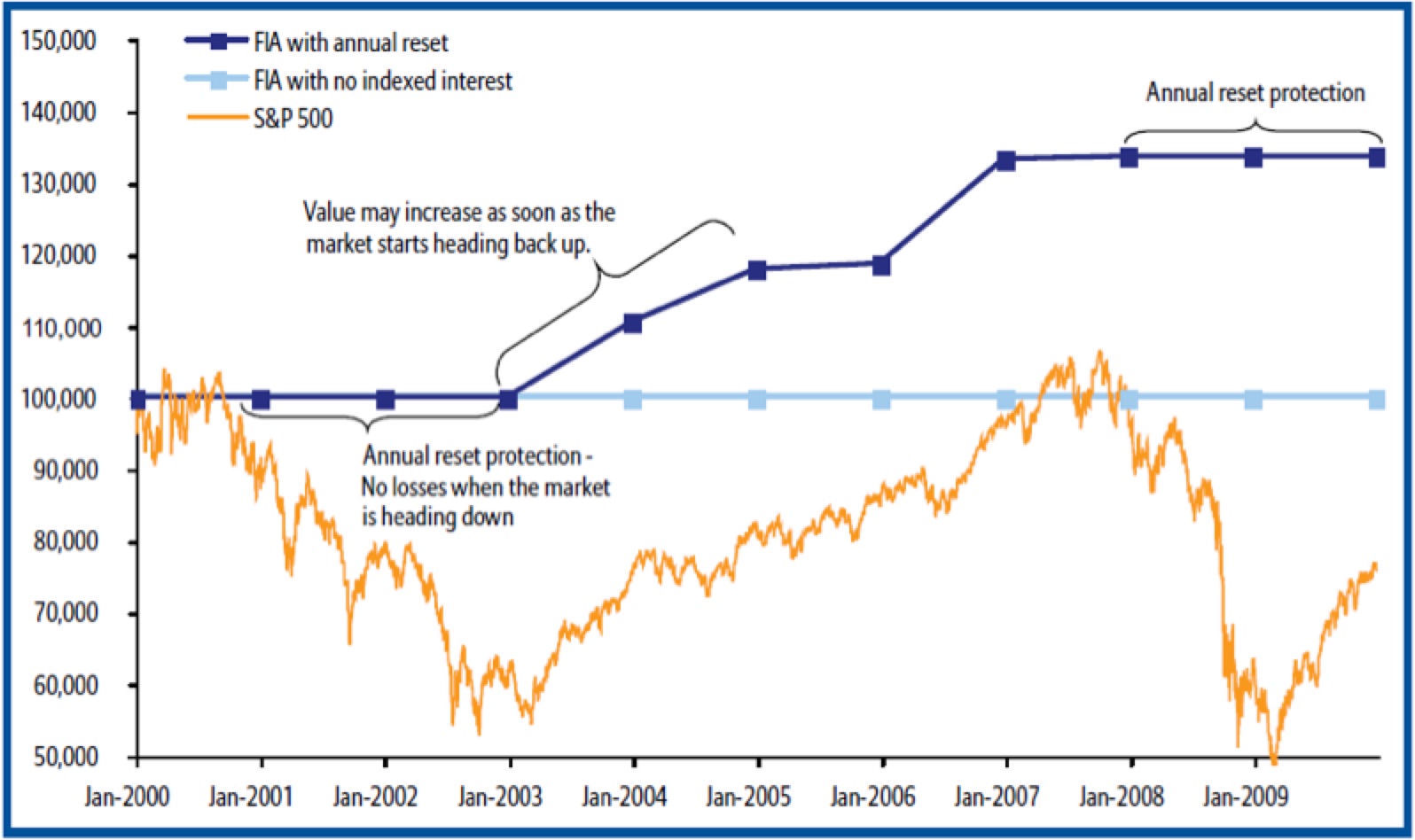

The chart below shows an annuity with the annual reset feature, and it highlights how a fixed indexed annuity could perform based on the performance of the S&P 500 as the underlying market index between January 1, 2000 and January 1, 2010.

Keep in mind that this time frame includes a period where the market incurred significant losses – yet the FIA in this example was still able to withstand this substantial market volatility and provide a nice return due in large part to the annual reset feature.

The annual reset feature on a fixed indexed annuity can be an advantage to the annuity owner, regardless of whether the underlying market index goes up or goes down. For example, when the index goes up, the account will obtain the higher return that is credited as interest, and in turn, locks in and becomes the following year’s beginning value.

Conversely, should the underlying index go down, no interest is received; however, no money is lost either. There is no need to build the account back up over time due to a small, or large, market loss.

For someone who is approaching retirement, this feature can provide an ideal situation, especially if these funds will be used in the future for converting into income. When considering a fixed indexed annuity, having the annual reset feature can mean being able to sleep at night, knowing that funds will be protected and “locked in” both now and in the future.

P.S. – Please share this article with others by simply clicking on the blue social media icons at the top of your screen!

Annuity123 does not offer insurance, investment, or tax advice. You should always seek the guidance of qualified and licensed professionals concerning your personal insurance, investment, or tax matters. Annuity123 is simply a platform allowing retirement planning professionals to help educate the community on various retirement planning topics. Annuity123 does not directly support or take responsibility for ensuring the accuracy of the content displayed in the articles themselves or any feedback that may get added in the Comments section from the community.

1 Comment

At one’s anniversary is the insurance company allowed to change the cap rate, participation rate, and spread? If they can do this, how does one know that the initial rate at purchase is not a teaser rate and rates will not go lower?

In your opinion is a market value adjustment rider worth the cost in today’s interest environment for a 6 year fixed index annuity as I am considering purchasing this annuity?